sales tax office austin texas

Click here to find other recent sales tax rate changes in Texas. County tax assessor-collector offices provide most vehicle title and registration services including.

Tiny Texas Government Scores Big Tax Breaks Across State

Austin Texas Sales Tax.

. 01-115 Texas Sales and Use Tax Return Outlet Supplement PDF 01-116 Texas Sales and Use Tax Return List Supplement PDF 01-148 Texas Sales and Use Tax Return Credits and. This office strives to provide you the. The current total local sales tax rate in Austin TX is 8250.

The Austin sales tax has been changed within the last year. Please be aware there is NO CHARGE to file a homestead exemption application with the appraisal district. If you know what service you need use the main.

Johnson State Office Building. It was raised 175 from 65 to 825 in October 2022. Texas Comptroller of Public Accounts.

Enter the name of the business WITHOUT commas. General Comptroller of Public Accounts Address. Texas Comptroller of Public Accounts The Texas Comptrollers office is the states chief tax collector accountant revenue estimator and treasurer.

Williamson County Tax Assessor Taylor Annex. This is the total of state county and city sales tax rates. When you need an auditor on your side.

On this website on the forms. Homestead applications are available. You can print a 825 sales tax table here.

Obtain information about the business location. The Texas sales tax. On the West steps of the county courthouse 1000 Guadalupe St Austin TX 78701.

Arrive before 10 am. Johnson State Office Building 111 East 17th Street Austin Texas 78774 United States 800-252-5555. Learn more about obtaining sales tax permits and paying your sales and use taxes for your business.

The Austin Texas sales tax is 825 consisting of 625 Texas state sales tax and 200 Austin local sales taxesThe local sales tax consists of a 100 city sales tax and a 100 special. Greater Austin Tax provides a flexible right-sized solution for small and medium sized businesses who need Texas sales and use tax expertise. What is the sales tax rate in Austin Texas.

County Parish Government Justice Courts. 111 East 17th Street. The December 2020 total local sales tax rate was also 8250.

5501 Airport Blvd Austin TX 78751. Several online services are available 247 on. The minimum combined 2022 sales tax rate for Austin Texas is.

Tax Information from the Texas Comptrollers. Tax sales are held the first Tuesday of the month at 10 am. The Tax Office collects fees for a variety of state and local government agencies and proudly registers voters in Travis County.

At the Travis County Heman Sweatt Courthouse 1000 Guadalupe St Austin TX 78701 to check in and receive your auction number. 312 S Main St. If the first Tuesday of the month.

What You Need To Know About Texas Sales Tax Holiday

Austin Film Commission Incentives Grants

Tesla To Move Headquarters To Texas From Palo Alto Los Angeles Times

City Sets Another Monthly Record For Sale Tax Collections Local News Heraldbanner Com

Grant Street Group Hosts High Demand Auction For Texas Comptroller Selling 8 Billion In Short Term Notes Pittsburgh Pa Grant Street Group

/static.texastribune.org/media/files/a366b3c65ffaf999c92401ba8562b290/Capitol%20File%20Jan%202022%20JV%20TT%2026)

Texas Comptroller 2023 Legislature Will Have Extra 27 Billion To Spend The Texas Tribune

What You Need To Know About Texas Sales Tax Holiday This Weekend

Texas Sales Tax Holiday On School Supplies Planned For Aug 5 7 Community Impact

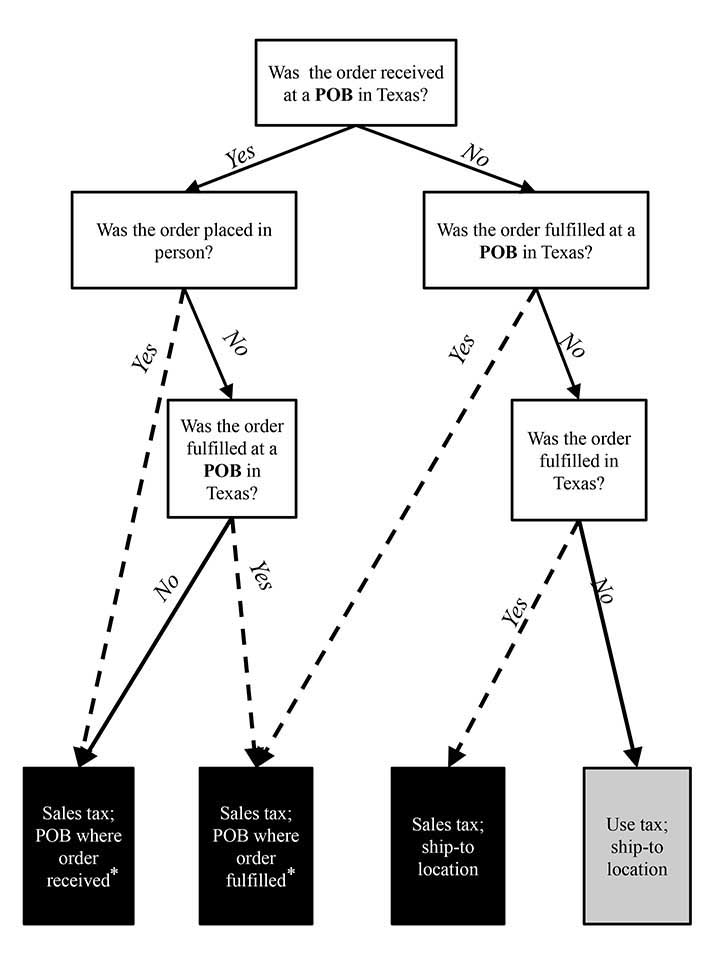

Local Sales And Use Tax Collection A Guide For Sellers

Texas Sales Tax Holiday Save On Back To School Supplies

City Tax Increase Likely But Not 8 Percent Austin Monitoraustin Monitor